In the hospitality industry, guest satisfaction is always the priority, and providing a seamless payment experience is integral to that goal. However, managing payments comes with its own set of issues that hotels face daily. From adapting to new technologies to accommodating guest preferences such as “pay when you leave hotel” and “pay when you check out” options, hoteliers are under constant pressure to provide flexible, secure payment solutions.

1. Understanding the Complexity of Hotel Payment Challenges

Hotels are not just a place to sleep; they offer dining, activities, and retail services, all of which require a payment system that can handle diverse transaction types. This diversity introduces several “Hotel Payment Challenges.” Processing payments securely, tracking various purchases, and handling post-checkout transactions add layers of complexity to hotel operations.

One primary “Hotel Payment Challenge” is ensuring guests feel comfortable with the security of their payment data. Guests today are wary of security breaches, and many prefer flexible payment options to avoid handing over credit card information in advance. In response, hotels are embracing payment solutions that prioritize guest control, allowing guests to “pay when you leave hotel” or “pay when you check out,” rather than at check-in.

2. Security Issues in Hotel Payments

Security is one of the most pressing “Hotel Payment Challenges” for any hotel chain, from boutique hotels to global brands. Hotels are prime targets for hackers due to the vast amount of personal data they store. Not only do they handle payment details, but they also manage information on preferences, addresses, and sometimes even passport details.

Hoteliers have started turning to digital payment methods, encryption, and tokenization to enhance payment security. These solutions help keep transactions safe without requiring the hotel to store sensitive card data. However, many hotels still rely on credit card authorizations taken at check-in as a guarantee against any unpaid charges, which can be a vulnerability if not managed properly. Increasingly, “pay when you check out” policies are being adopted as they add another layer of guest control, but even these require strong security measures.

3. Payment Flexibility and Guest Preferences

Flexibility is another challenge that hotels must address. Today’s guests have come to expect control over how and when they pay. This expectation often manifests as a preference for the “pay when you leave hotel” option, which allows guests to settle their bill at the end of their stay, rather than paying in advance.

This preference also ties into loyalty and satisfaction, as guests may feel that they are being provided a more tailored and convenient service. Hotels have responded by implementing flexible payment systems that cater to these preferences, making the checkout process as seamless as possible. However, offering these flexible options while managing the associated risks remains a notable “Hotel Payment Challenge.”

4. Balancing Mobile and Contactless Payment Options

As digital transformation sweeps the hospitality industry, mobile and contactless payments are becoming more common. Many guests prefer to complete their transactions using mobile apps or contactless cards, both of which support the “pay when you check out” and “pay when you leave hotel” preferences. Implementing these options requires that hotels upgrade their systems to accommodate these methods, which can be costly and time-consuming.

Further, contactless payment options offer a fast and hygienic solution, which has become particularly desirable post-pandemic. Although this technology has many advantages, it also brings challenges related to system integration, security, and guest adoption, making it yet another “Hotel Payment Challenge” that hoteliers must overcome.

5. High Costs of Payment Processing

Every payment transaction involves processing fees, which can add up quickly, especially when multiple payment options are offered. Hotels often need to pay fees on each transaction, which can vary depending on the payment type, the country of the guest’s card issuer, and other factors. Although offering “pay when you leave hotel” and “pay when you check out” options might enhance the guest experience, these options can increase operational costs due to higher processing fees for delayed or card-on-file payments.

As part of managing “Hotel Payment Challenges,” hotels are seeking partnerships with payment processing companies that offer competitive rates and enhanced services. Payment gateway providers that specialize in hospitality are often preferred as they offer tailored solutions to address these specific challenges.

6. Post-Checkout Payment Solutions for Additional Purchases

A less-discussed “Hotel Payment Challenge” occurs post-checkout when guests realize they’ve left personal items behind or want to make additional purchases. In such cases, traditional payment methods require guests to provide their credit card details over the phone or via email, which is far from ideal from a security perspective.

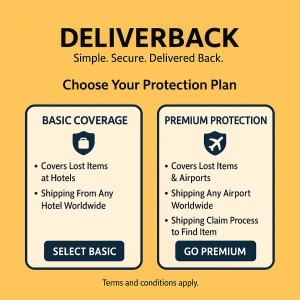

Deliverback as a Secure Post-Checkout Solution

Deliverback offers a secure alternative to traditional payment solutions for post-checkout purchases or item retrieval. With Deliverback, hotels can securely bill guests after they’ve left, without the need to request sensitive credit card information again. For example, if a guest accidentally leaves an item behind or decides to purchase an item from the hotel’s store post-checkout, Deliverback enables a hassle-free transaction that’s secure and compliant. This option enhances the “pay when you check out” experience, allowing hotels to provide exceptional service even after a guest has left, while maintaining strong data protection practices.

7. Emerging Trends and Technologies in Hotel Payments

As “Hotel Payment Challenges” continue to evolve, new technologies are emerging to meet these needs. The shift towards blockchain technology, for instance, is starting to make waves in the hotel industry. Blockchain can simplify cross-border transactions, improve data security, and offer transparency, which could address several hotel payment pain points.

Another trend is the rise of Artificial Intelligence (AI) in payment processing, which can detect and prevent fraud by analyzing transaction patterns. AI-powered solutions allow hotels to minimize fraudulent transactions while enhancing the guest experience with secure, seamless payment options that support the “pay when you leave hotel” and “pay when you check out” preferences.

8. Meeting the Needs of Corporate Guests and Group Bookings

Corporate guests and group bookings present unique payment requirements that further complicate “Hotel Payment Challenges.” Corporate clients often prefer invoicing options rather than immediate payments, while group bookings might involve multiple transactions and split bills.

Hotels are exploring ways to streamline payments for these cases, but ensuring a seamless experience while securing payment data is a challenge. Offering the “pay when you check out” option helps meet the flexibility that corporate clients desire, but managing these varied requirements on top of individual guest preferences remains complex. Some hotels are addressing this by creating specialized payment portals or dedicated payment departments.

9. The Role of Fintech Partnerships in Addressing Hotel Payment Challenges

To tackle the broad spectrum of “Hotel Payment Challenges,” many hotels are partnering with fintech companies that specialize in secure, guest-centric payment solutions. These partnerships allow hotels to implement systems that integrate multiple payment options, address security concerns, and enhance the guest experience with options such as “pay when you leave hotel” and “pay when you check out.” Fintech partners can also provide support with compliance, ensuring that hotels adhere to local and international regulations, which is particularly important when handling international transactions.

10. Conclusion: The Future of Hotel Payments

As the hospitality industry becomes increasingly digital, adapting to emerging trends and guest expectations is crucial. From providing secure and flexible payment options to managing post-checkout purchases, hotels face a myriad of “Hotel Payment Challenges” that require innovative solutions. With options like “pay when you leave hotel” and “pay when you check out,” hotels can offer convenience and security, meeting the demands of today’s tech-savvy travelers.

Hotels that invest in secure and flexible payment solutions stand to gain a competitive edge, fostering guest loyalty and boosting satisfaction. By staying ahead of these challenges and incorporating solutions like Deliverback, hotels can maintain a strong reputation and provide exceptional service throughout the entire guest journey—before, during, and even after checkout.