Many hotels aim to offer exceptional guest experiences, including assisting guests in retrieving forgotten items. While some hotels request credit card details over the phone or email to charge guests for the shipping of these items, this practice comes with significant concerns under European law. Here’s why hotels should reconsider this approach and what they can do to comply with regulations and maintain guest trust.

1. Data Protection Regulations

The General Data Protection Regulation (GDPR) has set strict guidelines on how businesses handle personal data. Credit card information is classified as highly sensitive data. Collecting, processing, or storing this data without proper security measures can lead to severe legal consequences, including fines and reputational damage.

Under GDPR, businesses must ensure that personal data is:

-

Collected lawfully, fairly, and transparently.

-

Processed securely, protecting it from unauthorized access or misuse.

Requesting credit card information over unsecured channels such as phone calls or email can expose sensitive data to potential breaches. Any mishandling or loss of card data puts both the guest and the hotel at risk.

Why Is GDPR So Important?

GDPR is not just a recommendation—it is enforceable law across the European Union and applies to any business handling data of EU residents. Hotels that fail to meet GDPR requirements face penalties that can reach up to €20 million or 4% of annual global revenue, whichever is higher. Beyond financial consequences, violating GDPR can also damage brand reputation and result in loss of guest trust.

Additionally, GDPR requires that businesses only process data for a specific and lawful purpose. Collecting credit card information for shipping forgotten items may not always be justified as a legal basis unless consent is clear, informed, and freely given.

2. PCI DSS Compliance

Hotels that handle credit card information must also comply with the Payment Card Industry Data Security Standard (PCI DSS). This set of security standards ensures that all card data is handled, processed, and stored securely. Failing to comply can result in penalties, loss of the ability to process card payments, and significant damage to a hotel’s reputation.

Why Non-Secure Methods Fall Short

Collecting card details through non-secure methods (e.g., phone calls or emails) does not meet PCI DSS requirements. These methods lack the encryption and security controls necessary for protecting cardholder data. For example:

-

Email: Emails are not encrypted end-to-end, leaving card details vulnerable to interception.

-

Phone Calls: While phone calls may feel secure, they often lack secure call recording or payment masking technologies. Additionally, any paper notes taken during the call pose a risk if not properly destroyed.

Hotels that fail to comply with PCI DSS may face serious consequences, including heavy fines, payment restrictions, and increased audit requirements. In worst-case scenarios, hotels risk becoming targets for fraud or data breaches, which can affect future bookings and guest confidence.

3. Risk to Guest Trust

Guests trust hotels to protect their personal information. Asking for card details through insecure channels can erode that trust and lead to negative reviews, reluctance to return, or even public complaints. In the digital age, where data security is a priority, guests are increasingly aware of the risks associated with sharing sensitive information.

The Reputation Damage

Modern travelers read online reviews before making bookings. A single data mishandling incident can snowball into a series of negative reviews and social media backlash. Potential guests may hesitate to book a stay if they see comments about insecure or outdated practices related to credit card handling.

In addition, if guests experience fraudulent activity on their accounts after providing card information to a hotel, they are likely to associate the hotel with that breach—even if the hotel itself was not directly at fault. Once trust is broken, it is difficult to restore.

The Legal Risks

Beyond reputation, guests who believe their card information was mishandled could escalate the situation legally. Under GDPR, individuals have the right to lodge complaints with data protection authorities or even seek compensation for damages resulting from data breaches.

What Hotels Can Do Instead

To maintain compliance with European regulations and ensure guest satisfaction, hotels should adopt safer practices:

-

Use Secure Payment Platforms: Utilize secure online payment platforms that comply with PCI DSS and have built-in encryption to protect data. Platforms such as Stripe, PayPal, or hotel management systems with integrated payment solutions provide guests with a secure way to process payments.

-

Provide Clear Instructions: Guide guests on using these platforms for any payments related to shipping fees. For example, hotels can send a secure payment link via email or SMS that directs the guest to a verified payment gateway.

-

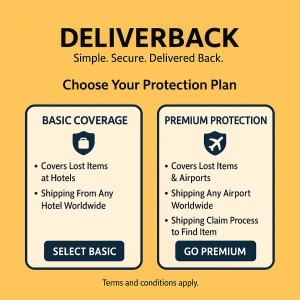

Work with Trusted Third-Party Services: Partner with services that specialize in handling lost-and-found logistics, offering both transparency and data protection. Companies like Deliverback provide a secure and seamless way for hotels to return items without handling sensitive payment data directly.

-

Inform Guests About Security: Reassure guests that their data is handled in compliance with GDPR and PCI DSS to build confidence in the process. Transparency about security measures can turn an otherwise stressful situation into a positive experience.

-

Adopt Tokenization: Tokenization technologies replace sensitive credit card information with non-sensitive tokens, which significantly reduces the risk of data breaches. This method ensures that hotels never store raw card details.

Examples of Secure Practices in Action

Some hotels have adopted innovative solutions to address lost-and-found scenarios securely:

-

Automated Payment Links: After identifying a guest’s lost item, the hotel sends an email with a secure payment link for the shipping fee. This approach ensures PCI compliance and reduces manual handling of sensitive data.

-

Third-Party Logistics Partners: Partnering with companies that manage item retrieval and shipping provides peace of mind for both hotels and guests. These partners often provide tracking options, secure payments, and streamlined communication.

-

Mobile Applications: Hotels with dedicated apps can integrate secure payment options directly within the platform. This not only simplifies the process but also reassures guests of security.

Benefits of Adopting Secure Practices such as Deliverback!

Switching to secure payment methods offers numerous benefits for hotels:

-

Legal Compliance: Ensures adherence to GDPR and PCI DSS regulations, avoiding legal penalties.

-

Guest Satisfaction: Guests appreciate clear, secure processes, which can enhance loyalty and trust.

-

Improved Reputation: Demonstrating a commitment to data security reinforces the hotel’s reputation as a professional and reliable business.

-

Operational Efficiency: Secure, automated solutions reduce manual work for hotel staff and minimize errors.

Conclusion

While helping guests retrieve lost items is an excellent way to provide top-notch service, requesting credit card details over unsecured channels is not advisable. This practice exposes hotels to risks under GDPR and PCI DSS while damaging guest trust.

By adopting secure payment platforms, working with third-party logistics services, and communicating transparently with guests, hotels can enhance their services while remaining compliant with European regulations. Making these changes not only safeguards the hotel from potential legal repercussions but also strengthens its reputation as a reliable and guest-focused establishment.

Hotels that prioritize data security today will position themselves as leaders in hospitality—earning the loyalty of modern travelers who value trust, convenience, and professionalism.