When it comes to business travel, having the right tools can make all the difference between a smooth journey and a stressful ordeal. One tool that savvy business travelers never leave home without is a reliable business airline credit card. Not only do these cards offer perks that make travel more comfortable, but they also help accumulate valuable miles and rewards that can be reinvested in future business trips. In this comprehensive guide, we’ll explore the ins and outs of business airline credit cards, how they can benefit you, and how to choose the right one for your travel needs. Plus, we’ll introduce a clever solution from Deliverback for when the travel gods inevitably throw a wrench in your plans.

Why Choose Business Airline Credit Cards?

Business airline credit cards are specifically designed to cater to the needs of frequent business travelers. Unlike standard credit cards, they offer a range of travel-specific benefits that can help save money, time, and stress. But what exactly makes these cards so beneficial for business travel? Let’s dive into some of the key advantages:

Earn Miles and Points: One of the biggest perks of business airline credit cards is the ability to earn miles or points on every purchase. These rewards can then be redeemed for flights, upgrades, and even hotel stays, making your business travel more affordable in the long run.

Airport Lounge Access: Many business airline credit cards provide complimentary or discounted access to airport lounges. This can be a game-changer for business travelers, offering a quiet and comfortable space to work, relax, or grab a bite before a flight.

Travel Insurance and Protection: Business airline credit cards often come with built-in travel insurance, covering everything from trip cancellations to lost luggage. This added protection can give you peace of mind, knowing you’re covered in case of unexpected travel disruptions.

Priority Boarding and Check-In: Some business airline credit cards offer priority boarding and check-in, allowing you to skip the lines and get settled on your flight faster. This perk is especially useful for busy professionals who want to maximize their time.

Waived Baggage Fees: Frequent flyers know that checked baggage fees can add up quickly. Many business airline credit cards waive these fees, which can save you a significant amount of money over time, especially if you frequently travel with equipment or promotional materials.

Popular Business Airline Credit Cards and What They Offer

To help you navigate the vast array of options available, here are some popular business airline credit cards and the benefits they provide:

American Express Business Platinum Card:

- Earning Rates: 5x Membership Rewards points on flights and prepaid hotels booked through Amex Travel.

- Perks: Complimentary access to Centurion Lounges, Delta Sky Clubs when flying Delta, and Priority Pass lounges. The card also provides $200 in airline fee credits annually, Global Entry/TSA PreCheck fee reimbursement, and comprehensive travel insurance.

- Annual Fee: $695, which can be offset by the substantial perks offered to frequent travelers.

Chase Ink Business Preferred Credit Card:

- Earning Rates: 3x points on travel, shipping, internet, cable, phone services, and advertising purchases (on the first $150,000 spent annually).

- Perks: Points can be transferred to Chase’s airline and hotel partners or redeemed for 25% more value through Chase Ultimate Rewards. This card also offers travel insurance, rental car insurance, and no foreign transaction fees.

- Annual Fee: $95, making it a cost-effective option for earning versatile travel rewards.

Delta SkyMiles Gold Business American Express Card:

- Earning Rates: 2x miles on Delta purchases, U.S. advertising in select media, U.S. shipping, and dining. 1x miles on other purchases.

- Perks: First checked bag free on Delta flights, priority boarding, and 20% savings on in-flight purchases. This card also provides access to Pay with Miles, a flexible redemption option that can lower the cost of Delta flights.

- Annual Fee: $0 introductory fee for the first year, then $99. This card is ideal for frequent Delta flyers who want to earn miles without a high annual fee.

United Business Card:

- Earning Rates: 2x miles on United purchases, dining, gas stations, office supply stores, and transit. 1x miles on all other purchases.

- Perks: Free first checked bag, priority boarding, and two United Club one-time passes per year. Additionally, cardholders can enjoy 25% back on in-flight purchases and no foreign transaction fees.

- Annual Fee: $99, a reasonable fee for United Airlines loyalists who want to maximize their travel benefits.

CitiBusiness® / AAdvantage® Platinum Select® Mastercard®:

- Earning Rates: 2x miles on American Airlines purchases, telecommunications, cable and satellite providers, car rentals, and gas stations.

- Perks: Free first checked bag on domestic American Airlines flights, preferred boarding, and 25% savings on in-flight purchases. The card also offers a companion certificate after spending $30,000 in a year.

- Annual Fee: $99, waived for the first year, making it an attractive option for small business owners who frequently fly American Airlines.

Choosing the Right Business Airline Credit Card

With so many options on the market, selecting the right business airline credit card can feel overwhelming. To make the decision easier, consider the following factors:

Airline Loyalty: If you frequently fly with a specific airline, consider a co-branded business airline credit card. These cards often provide the most valuable perks and rewards for loyal customers, such as bonus miles on flights, priority boarding, and free checked bags.

Annual Fees: While some business airline credit cards come with hefty annual fees, the benefits they offer can often outweigh the cost. However, if you’re a light traveler or just starting out, you may want to opt for a card with a lower fee until you can fully utilize the perks.

Rewards Program Flexibility: Some business airline credit cards offer points or miles that can only be redeemed with a specific airline, while others allow you to use rewards with multiple carriers or transfer them to other travel partners. If you value flexibility, look for a card with a versatile rewards program.

Spending Categories: Different cards offer varying rewards rates on different spending categories. Consider where you spend the most money—whether it’s on flights, hotels, dining, or office supplies—and choose a card that maximizes rewards in those areas.

Additional Perks: Beyond miles and points, look for other perks that can enhance your business travel experience. These might include complimentary lounge access, travel insurance, rental car insurance, and discounts on in-flight purchases.

Maximize Your Business Airline Credit Card Benefits

Once you’ve chosen the perfect business airline credit card, it’s time to maximize the benefits. Here are some tips to help you get the most out of your card:

Use Your Card for All Travel Purchases: To rack up miles or points quickly, use your business airline credit card for all travel-related expenses, including flights, hotels, rental cars, and dining.

Pay Off Your Balance Monthly: To avoid paying interest, always pay off your balance in full each month. The last thing you want is for the rewards you earn to be negated by high-interest charges.

Take Advantage of Sign-Up Bonuses: Many business airline credit cards offer generous sign-up bonuses if you spend a certain amount within the first few months. Plan your purchases strategically to hit that target and earn those extra miles.

Monitor Your Rewards and Expiration Dates: Keep track of your miles and points to ensure they don’t expire. Some programs require you to make a qualifying purchase every so often to keep your rewards active.

Leverage Airline Partners: Many airlines have partnerships with other carriers and travel companies. Use your miles with these partners to take advantage of more flight options and destinations.

Business Airline Credit Cards and Deliverback: A Perfect Travel Duo

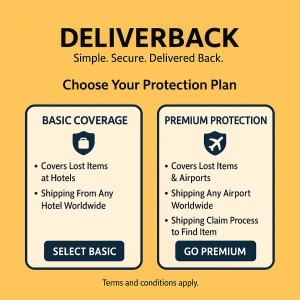

As fantastic as business airline credit cards are for racking up rewards and enjoying perks, they can’t help you when things go wrong—like when you accidentally leave your laptop at airport security or your suit jacket in a hotel closet. That’s where Deliverback comes into play.

Deliverback specializes in reuniting travelers with their lost belongings, whether they’ve been left behind at a hotel, airport, or even in an Uber. Here’s how it works: you simply report your lost item through the Deliverback platform, and they coordinate with the location to retrieve your item and ship it back to you. It’s a lifesaver for business travelers who need to stay on top of their game.

Think about it: you’re using your business airline credit card to earn miles and breeze through the airport, only to realize mid-flight that you left your power bank charging in the lounge. Instead of panicking (or worse, buying a pricey replacement), you can contact Deliverback and have it shipped to your next destination or back home.

This makes Deliverback and business airline credit cards the perfect combo for any frequent traveler: one helps you earn rewards and enjoy perks, while the other ensures that even if you’re a little forgetful, you won’t be without your essentials for long.

Conclusion: Making the Most of Business Airline Credit Cards

Business airline credit cards can be a powerful tool for frequent business travelers, offering a range of benefits from earning miles to enjoying VIP treatment at airports. By choosing the right card and using it wisely, you can make your business travel more enjoyable, efficient, and rewarding